I have been an entrepreneur all my life, but have never really been an investor. I started Wired Investors 2 years ago, and both my partners at the time came from an institutional investing background (both were also interns who visited Valle). So naturally I treated these last 2 years as an opportunity to vampirically suck the knowledge out of them.

My very growth-oriented entrepreneurial nature combined with the fact that Wired Investors was a ridiculously fast-growing company meant that we did a lot of swinging for home-runs. We missed most of them, but going through the motions allowed us to learn a ton as well as shatter several floors worth of glass ceilings. Here are some of the more notable endeavors we took that really made me level up my institutional investment game:

- Spent 3 months negotiating and ultimately declined becoming public on the Canadian Ventures Stock Exchange via RTO (Reverse Take-Over).

- Negotiated and ultimately declined an exit to a multi-billion dollar private company.

- Negotiated and ultimately delayed an opportunity to raise 300 Million USD from one of the largest money placers in the world.

- Helped several successful presales for crypto token sales (mainly on the private institutional fundraising side).

In this post I will try to take a birds-eye view of what I learned from all of the above.

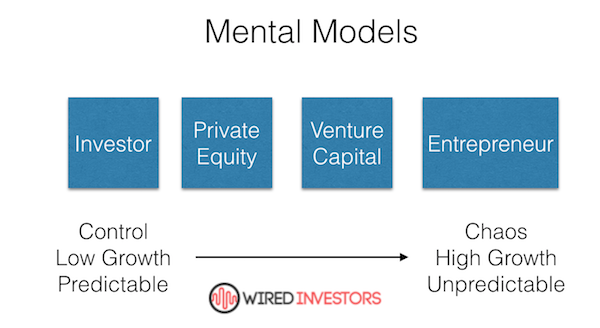

I used to see investing and entrepreneurship as two opposite ends of a spectrum. Investors were fear-driven while entrepreneurs were growth-driven, and I was not good at investing because I was an entrepreneur. This was not accurate.

I now see that they are two separate mental models, and you need to know which model to use to solve a problem. “A man armed with only a hammer sees every problem as a nail”. That’s the way I was with business.

What Is A Mental Model?

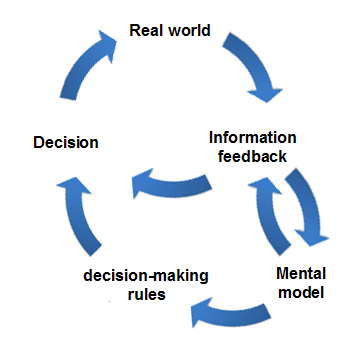

A mental model is essentially a framework for decision making. For example, investor and author Tren Griffin has written about critical mass and network effect models. Today I’m going to discuss entrepreneurship vs investment mental models.

The Entrepreneurship Mental Model is based on chaos and growth.

Two key elements to the bootstrapper’s model are Minimum Viable Products and growth-hacking. The very nature of this model acknowledges and embraces unpredictability, chaos, and failure. It is entirely growth oriented without predictable returns – you’re trying to 100x growth at all times. It’s also a single egg in a single basket. Approaching investment with this model can be disastrous.

The Investment Mental Model is based on order and protecting downside

The investor defines his Investment Thesis and purposely gives himself restraints, finding reasons to say no to the majority of the investment opportunities you get, and balancing the few investments you say yes to with caution. Approaching entrepreneurship with this model can also be disastrous.

For example, Private equity is an overlap that is skewed towards the investment side. Private Equity firms spend months going over a “deal”, discounting its inherent risks vs other opportunities, and then balancing it with others investments in their portfolio.

They work with other investor’s money and charge fees for their efforts. The standard “2 and 20” fees charged gives the PE firm 2% of the investment per year to cover operational costs, and 20% of the profit (over a basic hurdle). This is obviously nothing compares to owning a business outright, but it keeps with the focus of protecting downside.

Venture Capital (Angel Investing, Series A, etc) is an overlap that is skewed in favor of entrepreneurship. Hit rates are much, much lower, but venture money is also”cheaper”.

Everyone who knows me will tell you that when I am presented with a black and white option, I always choose grey. This is just part of my personality and I don’t necessarily recommend it, as I will do it even if it’s not the best option.

I always prioritize learning, and learn best by trailblazing.

So Wired Investors naturally took this route. It is an overlap that’s positioned right in between VC and PE. Operationally we do a lot more than PE, but a lot less than VC. Our focus is on predictable wins that we can recycle across the portfolio of businesses. A “bag of tricks” in which each trick gives the majority of our businesses a predictable 10% lift. Our fees to investors are also positioned between both…

A personal note

I am convinced this is the best business model for Wired and it’s unique set of owners. But once everything was setup, it became too predictable for me. I think that’s why I swang for all the aforementioned home-runs. It’s also the reason I re-launched NoHatDigital, and the reason I’ll be putting a bit less time into Wired Investors going forward.

What I am putting my time into is the crypto space.

Bart Stephens from Blockchain.Capital recently said in an interview on the Boost VC Podcast, “[The crypto space has] got its own special culture. The folks that populate our industry are free-thinkers and renegades, and they have interesting ideas about changing the financial system as we know it.” I couldn’t agree more.

It is the perfect space for me, as not only does it overlap between entrepreneurship and investing (much heavier on the entrepreneurship side), but it rewards trailblazers and innovation more than any space I’ve seen. Because of this, I will be doing some posts on crypto in the coming weeks/months, as I believe the future there is absolutely massive.

Now for the actionable stuff

If you’re in the same position as I was, how can you learn the 80/20 of investing as efficiently as possible? This question has been on my mind a lot as Ken and I work on the curriculum for NoHatUniversity. I’d say the first thing is understanding the process of buying a business. Specifically:

- What to ask for in a P&L. Here’s a template, feel free to play with it and use something similar if you do your own dealflow. Make sure you use add-backs.

- Identifying areas of growth.

- Charting that growth on a basic operating model, with a cautious and an optimistic version of the model. Here’s an example. Replace sample session and revenue data.

- Charting financing options and your capitalization table on that model. See first how changing the multiple affects cashflow. Then see how debt vs equity with management fees affects cashflow. Try a version with a 3x EBITDA multiple, and pure SBA debt amortized over 10 years with an 8% annual interest rate, as this is quite common. Here’s a model that’s flexible enough to apply to any business with any financing.

If you find those free templates helpful, please share this post on social media.

Once you’ve done the above you will come to the conclusion that buying businesses in this space is ridiculously profitable. You will realize that structuring deals in the right way is more profitable and repeatable than building businesses.

And if you’re anything like me, you’ll think, “How can I scale the shit out of this?”. Believe me when I say there are multiple ways to turn this into a billion dollar opportunity.

But I’ve already got a business

If you’ve already got a business and you want to grow it, I encourage you to do a basic IRR comparison based on buying a business and structuring your financing intelligently vs hiring an employee. It also makes rollups make a lot more sense. It will blow your mind. I’ll be doing a post on this in the future.

Which example of mental models do you follow? Entrepreneur, Investor, or Overlap?

Let me know in the comments section below.

Martin says:

Hey Hayden,

Interesting post. I think the line is pretty thin given that many successful VC people were once entrepreneurs. I tend to believe that the successful PE/VC business is about the ability to increase value in the businesses you own. This is why, you need to be entrepreneurial in your thinking. Keep up with the good posts – I will be interested to read more about how you started – building a portfolio of digital businesses needs good money for investment :)

All the best,

Martin

Hayden says:

Glad you enjoyed the post Martin! I’m working on a few posts about how to raise money if you want to create a portfolio or buy a digital business of your own.

Chris Labbate says:

I have always found myself on the Entrepreneur side of things, finding new opportunities to scale and grow businesses has always been at the core of what I do. I recently picked up a new SEO gig for a Equity Capital firm and I have been learning a lot about their business model and how they structure deals. When I get a chance I will run some numbers with your template to gain more insight. I also caught your recent podcast on CryptoKnights covering ICOs and what to watch out for if your doing any investing in this space. https://www.podomatic.com/podcasts/cryptoknights/episodes/2018-01-13T11_50_36-08_00 (Just in case anyone missed it.) I see a lot of confusion and mass hysteria around the crypto space so it is good to find a clear voice that cuts through some of the noise. I agree with what you said in this article and its what some investors just don’t get, The folks behind crypto-currencies are thinkers and renegades, its not about getting rich (although I’m sure no one would mind) it has always been about permanently changing the financial system as we know it. Here’s to the revolution! Hoping to grow my investment mindset in the near future…as with all things I say, “middle pillar” but it the same grey area balance you speak of.

Hayden says:

Hey Chris – I’m excited you listened to the Podcast! Congrats on the new SEO gig. If you are running an agency, M&A can be huge. A friend of mine recently bought a high traffic blog using the client’s marketing budget to fund it, then replaced the ads and sold them to the client. There are tons of speculators/arbitrageurs in crypto, but I’m much more interested in using the technology to build real businesses. Viva la revolución!

Atti says:

“Identifying areas of growth. Here’s a post with what we think are the best opportunities in 2018.” Think here is a link missing :-)

Would love to read and learn more about buying digital businesses as well as building and managing a digital portfolio.

Glad nohatdigital is back :)

Hayden says:

Thanks for letting me know about that missing link Atti, I appreciate it. I just removed that sentence (will add it back when the opportunities post is ready). I’m going to post some more information on building + managing a portfolio this week.

George also has a good post here for beginners:

http://wiredinvestors.com/buy-and-sell-websites-online-investing-explained-part-i/