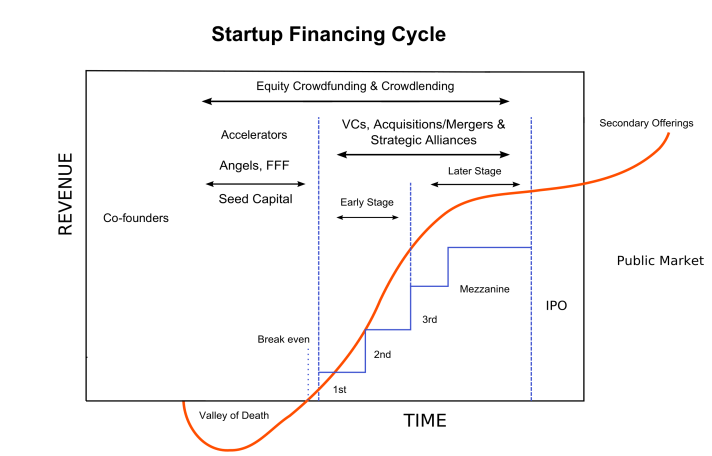

Generally when you buy a business, you will buy it based on a combination of debt and equity. This combination depends on your investment thesis. If you haven’t read the post on crafting your digital asset investment thesis, then stop reading this and read that now.

Ok now that you have an investment thesis, let’s talk about your financing options.

Equity with fees

Let’s first discuss raising external equity and charging a management fee. Basically you will be playing with other people’s money, operating the business(es) you purchase, and charging a management fee for doing so.

Institutional Investors

Institutional Investors are financial institutions. Generally speaking they are interested in alternative assets that can make them or their investors 20-25% per year ROI.

In Private Equity, the standard “2 and 20” fees charged gives the PE firm 2% of the investment per year to cover operational costs, and 20% of the profit (over a basic hurdle of around 7% annual ROI). So, if you wanted to buy a business for $1 million, you could take $20,000/yr in annual operational fees, and 20% of the profit above 6%. With the ridiculously low multiples in this space, buying something and just keeping it stable (profit doesn’t go up or down) is equal to a 30% return, meaning you’d get 20% of a 21% annual return.

Let’s separate that out for clarity.

A $1mm business bought at a 3x multiple after add-backs is earning $333,333.

After 1 year, operating fees of 2% take off $20,000, leaving profit at $313,333.

The 7% hurdle goes to investors first, which equals $70,000, leaving you (the operator) with a 20% share of $243,333, or $48,666.

So your total income (assuming you put $0 down), is $68,666.

Now let’s assume you had enough money to put in 5% of the deal value, or $50,000. Most investors would want to see skin in the game, and 5% is likely a minimum. You’d own 5% of the business, and would then be using $950,000 of investor money. So you’d get your 20k operating fee, then 5% of $313,333, or $15,665, then, 20% of the upside after a 7% or $66,500 hurdle, which is $49,366.

So that’s assuming zero growth. Let’s create another scenario in which you own 5% of the business, and you grow the business substantially – after 12 months the total earnings was $450,000.

You’d still get your 20k, then 5% of the 450k ($22,500), then 20% of anything above $66,500, which is 20% of 341,000 or $68,200.

So that’s private equity, and it’s the first reaction institutional investors will have when they look at what you do. PE firms with a solid history can charge 3/30 and or even 3/50, but the 2/20 will always be the first comparison on their minds. Keep in mind that institutional investors are generally not interested in a $1mm deal, they’d usually not talk to you unless they could start with $10mm, and eventually scale to $100mm or more. This is because they have expensive auditing requirements, and the due diligence on deal is pretty much the same if you’re spending 1mm or 100mm.

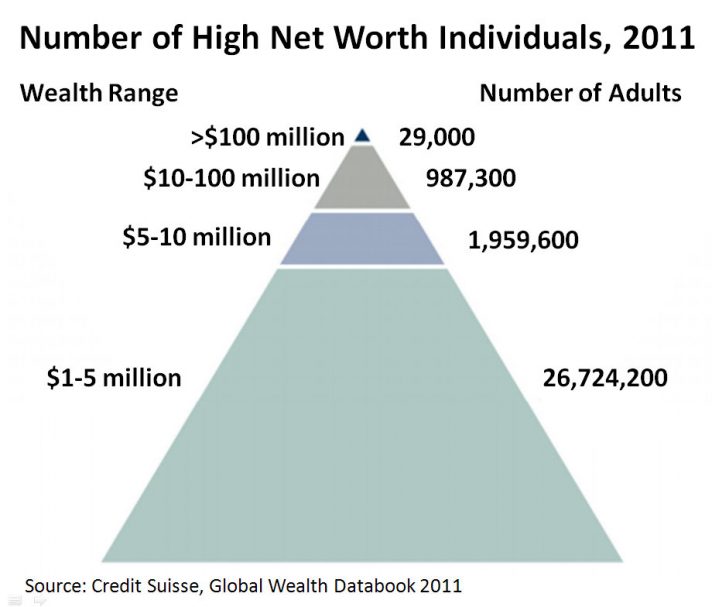

High Net Worth Individuals

Another option is raising money from High Net Worth Individuals (HNWIs). HNWIs are usually upper middle class people with extra money to invest. The advantage of HNWIs is that their closest comparison will be the returns they are getting on the stock market – meaning any kind of double digit return will likely make them happy.

I’ve seen people charge a flat 30% management fee, leaving the investor with 21% annual ROI assuming the deal is stagnant. Wired Investors‘ first deals charged 50% of the upside in a deal, and no operating fee, so we were only paid if we grew the businesses. We brought a team to Valle to work on them (they are now remote). Now that we have history, we charge 50% of the upside above a 15%/yr hurdle, which is equivalent to a 7.5 and 50 in private equity terms. As you might expect, we don’t work with private equity.

So that’s equity. Now let’s look at debt.

Debt

Good old debt, structured just like a car loan or mortgage, but with higher interest. The advantage of debt is that you get to keep the equity of the business. So if you for example financed the same $1mm business with 100% debt , amortized over 10 years with an 8% interest, your annual payment is $149,029. The function in excel is pmt(interest rate, term, principal) or pmt(0.08,10,1000000). Yes, I’m such a nerd I memorized the formula.

So assuming the business stays stagnant, you are the only equity holder and you will receive $333,333 minus $149,029 per year or $184,304 per year. Just keep in mind that you as the only equity holder now absorb all the liability. If the deal goes to zero, you are on the hook for a million buckaroos.

The above schedule is common with government programs like SBA in the US, or BDC in Canada. You can also raise debt from HNWIs, but you will likely need to pay 12% interest, and have no more than 5 year amortizations. Expressed as an excel formula that

would be: Pmt(0.12,5,1000000) or $277,409.73, leaving you with $55,914 profit per year. After 5 years however, you would be making the full $333,333 per year.

In almost all cases HNWIs and government programs will be your only options early on. Once you have history you can get more institutional money, though the terms will not be any better than SBA/BDC.

Where debt gets interesting is when you grow a business.

Using our growth example from the Equity explanation above, where through competent management you brought the business to $450,000 EBITDA, we could sell the business after a year, for the same multiple, and make $350k in profit. And if you can use rollups and purchase multiple businesses in the same vertical with debt, you could potentially exit at a higher multiple.

Finally, you can always custom tailor your deals with a combination of debt and equity to maximize your profit while keeping you in a comfortable risk profile. Play with the model here and create snapshots showing your returns based on different combinations. Please, share this post & the model with your friends.

Key Takeaways

- Financing a business can be done with debt, equity, or a combination

- High Net Worth Individuals and government loans are available early on

- Private equity and institutional investors are interested in larger, more established businesses

How do you finance your online businesses? Debt, equity, or a combination? Let me know in the comments below.

Ty says:

First $100,000 I borrowed to start affiliate sites was from Sofi loans. Took the $100k and in 22 months sold the site for $950,000. Some sleepless nights but it worked out.

You should talk about tax implications on the sale of a site and structuring it for protection.

You should let me put my sofi link here lol

Hayden says:

Interesting, I will add a section for online lenders and p2p options. I’ve not personally used them.

Congrats on the sale! Tax structuring is dependant on one’s nationality, I don’t really want to make this centered on any single country. Wired is a Barbados entity as I am Canadian and have a US partner. Though C-Corps in the US now remove a lot of the reasons to go offshore.