This post is part of our ultimate guide to running an online business.

Rollup strategy, is when a firm purchases multiple smaller businesses in the same space and merges them. There are 3 principle reasons to do a rollup:

- Economies of Scale, especially in operations

- Cross-selling

- Multiple Arbitrage

Let’s use an example to bring clarity to the above.

You decide to purchase a website that gets it’s traffic from Google around keywords related to caring for one’s dog. You buy it at a 3x multiple of it $250,000 /yr EBITDA. [You finance it with debt]. A couple months later as you’re working on the site, you find that a popular dog forum is also for sale. It also generates $250,000 /yr EBITDA, so you purchase it with debt as well. Since you’re on a roll, you do some more searching and find that a dogfood white label FBA business is for sale. This one you can buy for a 2x multiple, and it’s making $375,000/yr.

So all in all, you now have a dog website getting traffic from Google, a popular dog owner’s forum, and a dog food white label product. Collectively these bad boys are making $875,000/yr.

Let’s start with economies of scale in operations.

You now have in-house competence across multiple traffic sources and monetization channels. This means you can apply your Google competence to your dog food product, and apply your FBA product creation skillset and create products based on what people in your forum want. You could also potentially cut costs.

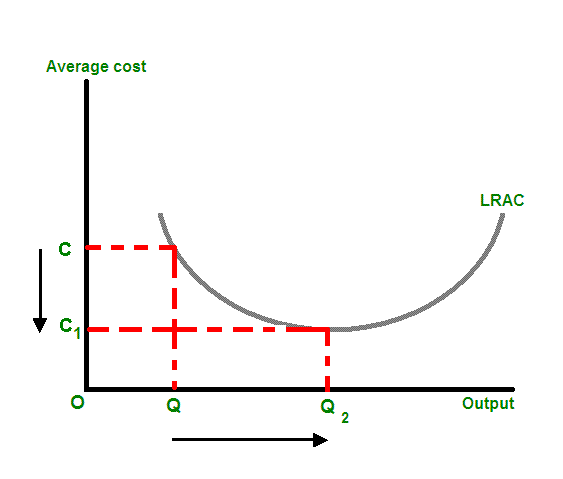

Rollups take advantage of Economies of Scale. As output increases average cost decreases, until it reaches an inflection point and the trend reverses.

You can cross-sell like crazy.

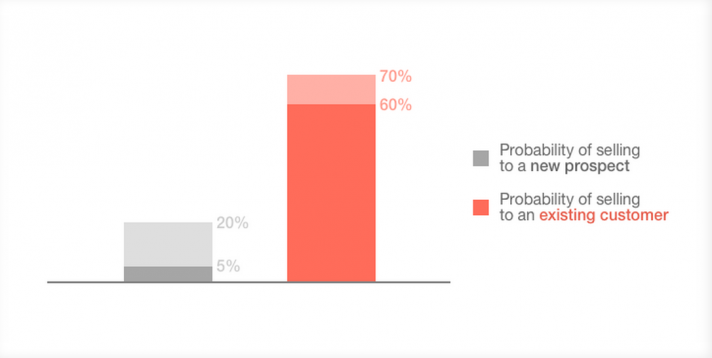

A cross-sell is when you offer additional services/products to existing customers. You can put ads on your forum and dog care website promoting your dog food product. Your dog food product can funnel people to the forum afterwards, and the forum can also funnel more people back to your dog care resources. Email lists can be shared, same with push notifications. Facebook channels and retargeting can be combined.

Between 1 and 2 above, even without any other tricks on your playbook, you could likely increase your overall business by 40% within a year (that’s being conservative). So the business is now making $1,225,000/yr

Source: Groove HQ

Finally let’s talk multiple arbitrage.

In the digital asset space this is the primary reason for doing a rollup. Understanding this space requires a broader understanding of buyers of larger assets. These buyers are usually private equity firms or public companies. Private Equity firms commonly buy at a multiple of 5-7x EBITDA, but because of their high audit and reporting costs as well as their own time requirements, they generally are not interested in deals that are making under 1 million a year.

Likewise, let’s say a public company has an average P/E ratio of 12. This means as long as they buy at under a 12x multiple (landed after all costs associated with the sale), the price of shares should go up. Since they are public, they have reporting requirements and audits as well, so they aren’t interested in looking at smaller deals.

In this case, a public company or PE firm would never have been interested in each of the 3 dog sites individually, but when combined your business up to a new buyer universe.

Now you can shop your business at a 6x multiple with confidence. Your 2.25mm is now worth $7,350,000.

Rollups mean you’re swimming in different pool of buyers (Pictured, Pool in Valle de Bravo)

Key Takeaways

- A rollup involves buying assets in the same vertical and merging them

- Economies of scale help you combine resources, grow competencies, and cut costs

- You can cross-sell products and ads between the properties

- A new class of buyers will pay more for your assets (multiple arbitrage)

If you learned something from this article please share it.

Can you think of some other advantages of rollups? Are your businesses related (rollup candidates) or unrelated (opportunistic)? Let me know in the comments below!

Sam says:

Incredible post and has opened my mind to many possibilities.

I particularly like the idea of accessing bigger buyers with greater EBITDA multiplies!