Last week a colleague of mine asked in a mastermind group how traditional business skills apply to the cryptocurrencies. He was debating whether it would be more profitable to invest in a cryptocurrency business or continue to invest in affiliate marketing websites. I’ve heard the question ten times before from both website investors and marketers. The responses were mixed:

“Crypto is a fad!”

“You can’t control it!”

My response was this:

“Whether a business is on the blockchain or not, your skills as a marketer and website investor are directly transferable. These cryptocurrency companies are well funded and they all need affiliate, finance, marketing, operations, and product development help.”

In 2017 cryptocurrency ICOs (initial coin offerings) outpaced angel & seed funding – to the tune of 3.8 billion dollars. That’s a huge opportunity for marketers. And as Hayden would say – we’re opportunistic motherfuckers.

In fact, many of the top marketers and SEOs have started businesses on the blockchain – from Neil Patel to Jon Haver.

Don’t get me wrong – I still have website investments in other niches. They diversify risk, and the returns are predictable. However, the potential upside, impact, and competition doesn’t even come close to cryptocurrency businesses.

To illustrate this point, let’s case study the largest crypto publisher: CoinMarketCap.com.

Coinmarketcap: Case Study & Upside

Coinmarketcap.com is a website that tracks cryptocurrency prices. Let’s take a look at them to demonstrate the opportunity of building or investing in a cryptocurrency website. This is the cream of the crop, but I chose it because we have insight into their advertising prices.

Traffic

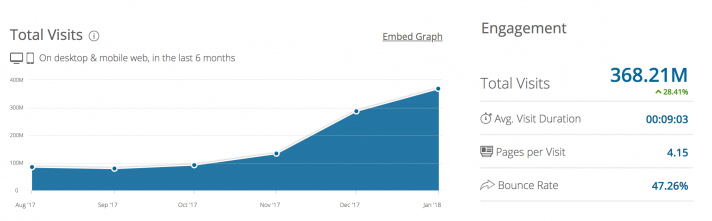

The total addressable market for cryptocurrency is much higher than a niche review site. Coinmarketcap had an estimated 368,000,000 visitors last month according to similarweb.com, up 28% from last month and 72% in the last 2 months. A lot of these are repeat visitors checking crypto prices multiple times per day, which we will get into later.

Absurd CPMs and Revenue

Over the last three months Hayden has advised several cryptocurrency startups that have advertised with Coinmarketcap. In three months the price for a 30 day advertisement for just the leaderboard has gone from $300,000 to $500,000 to $1,800,000. Why? An investor that puts in a minimum 1ETH contribution is worth $900 to that company at the current price of Ethereum. And that’s just for a minimum investment. Even if a company is past the funding stage, advertisements still help with token appreciation.

Let’s put these two together to find CPM.

The CPM is the cost per thousand impressions of advertising on a website. Coinmarketcap has 5 ad banners on the site – let’s assume they are all counting as 1 impression except for the bottom ad which 50% of visitors scroll to the bottom and see (I would adjust this lower if the page was long). We will count that bottom ad as .5 of an impression to make up for this. They get 4 pageviews according to Similarweb. I’m going to use a conservative estimate of 100M visitors from October.

$1,800,000 / 100,000,000 visitors * 1000 = $18 CPM

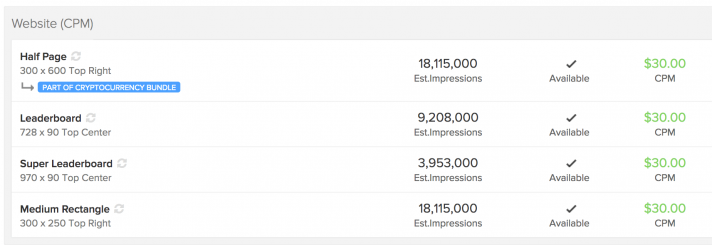

It’s even higher on competitors like Coindesk. According to BuySellAds they have a $30 CPM:

Info/affiliates sites earn much lower CPMs in the $2-$4 range, so you already need less traffic to make a crypto blog profitable.

So what’s Coinmarketcap making?

If we take 4.5 impressions per page * 4 pages per visit * 100,000,000 monthly visitors * $18 CPM / 1000 = $32,400,000 potential ad revenue for the month of October. Take January’s traffic into consideration and it’s over $100M.

Now, it’s unlikely they filled all of their ad inventory 100% here (though we know from conversations their leaderboard has been sold out well in advance). I see some retargeting and adsense backfills which would be earning a lower CPM. Even if we estimate that they filled 50% and earned $4 CPMs on the rest it’s still $50.2M.

Now let’s look at the visitor values.

I’m going to use the SEMrush Traffic Analysis Tool for this calculation because Similarweb doesn’t give us data on unique visitors (and I wanted to give you a free tool)*. They estimate traffic to be lower, at 141M visitors and 15M uniques in January. That’s because people are checking prices on the site multiple times per day. An $18 CPM * 141M * 4.5 ad impressions * 7 pageviews / 1000 = $80M in revenue.

* Looking at my own sites Similarweb seems to be much more accurate with traffic estimations.

Visitor value = Revenue / Unique Visitors

$80M/$15M = $5 Visitor Value

That’s crazy when you consider a typical Amazon affiliate site will have a $0.14 visitor value.

Basically Coinmarketcap is making an absurd amount of money.

New & Low Competition Keywords

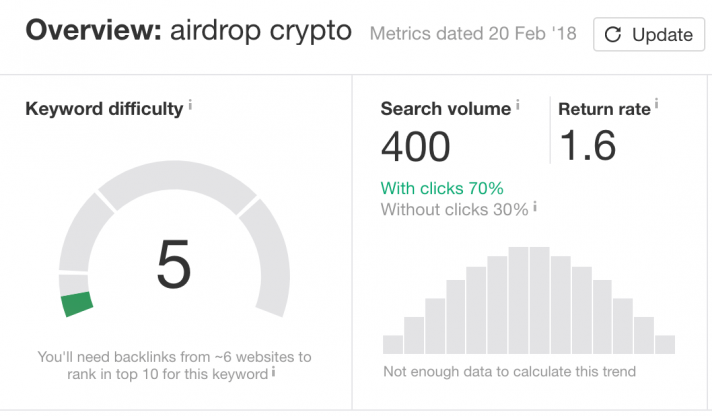

There’s no doubt keyword competition is heating up in this space. However, new entrants into this niche are creating keywords that didn’t exist 3 months ago.

For example, airdrops are the latest marketing strategy in crypto. In Ahrefs the competition is weak and we know this traffic is very valuable.

It’s like stepping back in a Google time machine.

The search volume is underestimated and competition relatively low for such high CPMs (compared to competitive niches like hosting and insurance).

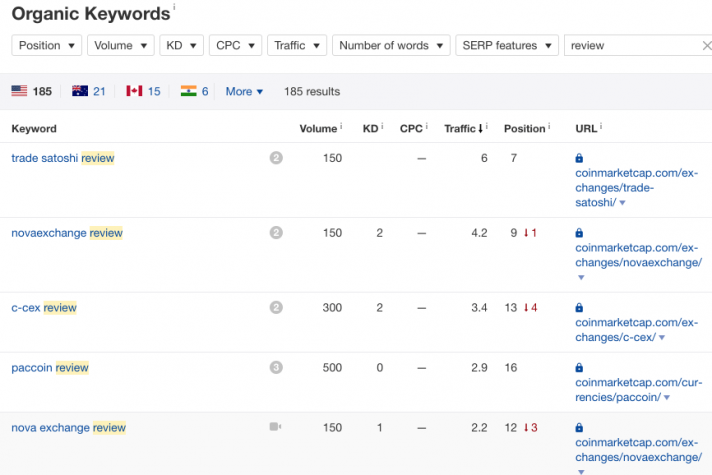

Coinmarketcap’s bread and butter is pricing related searches, but they are also ranking for review terms with very thin content because they have authority and the competition is so low.

Impact

Cryptocurrency projects have the potential to change the world. In fact, cryptocurrencies are booming in places like Africa and the Philippines, allowing millions without bank accounts to safely store and transfer money digitally. Hayden started a blockchain company right here in Mexico that allows small businesses to issue credit to their customers, with the goal of bringing fair access to credit and investments to people around the world.

It’s not just a money.

Ethereum based tokens are utilizing smart contracts to disrupt entire industries – from lending to insurance to gaming to real estate. They cut out the middleman and automatically execute contracts. This increases efficiency and passes the savings to the public.

Working on these types of projects is much more meaningful than affiliate sites. A review about the best doggy toys isn’t going to change the world.

Potential Crypto Paths For Marketers

- Service business based on crypto

As I said to my colleague, cryptocurrencies need help bringing their ideas to life and they have raised a massive amount of money to make it happen. This could

- Crypto affiliate marketing or publisher site

As we saw with Coinmarketcap, the CPMs for crypto advertisers are ridiculous. While there are some crypto affiliate programs out there you can earn much more by negotiating ad rates directly with cryptocurrency businesses.

- Forking or launching your own cryptocurrency

Here’s where things really get interesting. You can fund this through private investment, an ICO, or fork an existing token and airdrop to their current token holders.

- Investment via exchanges

The investment path is in my opinion the least interesting. You have little control over the outcome and the data is publicly available, meaning you have little edge over other investors.

- Pre-sales and ICOs

Similar issues to the above, though you can mitigate this risk by sourcing deals that are not yet public and evaluating them with a solid due diligence process.

How To Get Started

Here are a few of my favorite crypto resources for beginners:

Podcast – Tim Ferris Interview w/ Nick Szabo

Book – Cryptoassets: The Innovative Investor’s Guide To Bitcoin and Beyond

Blog/News – Coin Telegraph has some helpful 101 guides and covers common crypto topics in the “Explained” section.

I encourage you to share this post, as well as the above resources with other marketers.

Key takeaways

There are 3 reasons why marketers should learn crypto.

- Upside – CPMs are much higher and searches are growing

- Impact – You can make a difference

- Competition – Is much lower

Have you moved to crypto? Why? Let us know in the comments below!