When you raise funds for a company with an ICO these funds are generally deployed inefficiently into product development and marketing/promotion. Both take a long time to show ROI. However, companies that use funds for mergers and acquisitions scale quickly. Let’s apply the M&A process to cryptocurrencies in 3 different industries.

Goals & Challenges

We enter the picture as ICO advisors to a Latin American Fintech company.

The company recognizes that credit score issuers contribute to the highest costs in the lending process and its mission is to cut out the “middlemen” by moving scoring and lending to the blockchain.

It’s now doing an ICO in the peer to peer (P2P) lending space to raise funds to develop its blockchain technology.

Goals

Pre-ICO

- Create buzz, attract contributors and reach funding goals

Post-ICO

- Get the core product in as many hands as possible and increase the value of its token over time

- Deploy funds raised effectively

Challenges

Pre-ICO

- ICOs are now a dime a dozen. How can this company vie with other ICOs to gain the attention of investors?

Post-ICO

- Gaining widespread usage of the core product is hard and most tokens/coins fade into oblivion.

- How can we ensure the core product has demand and that its tokens increase in value?

- How can the company ensure that the funds raised are put to the best use and deployed with high ROI?

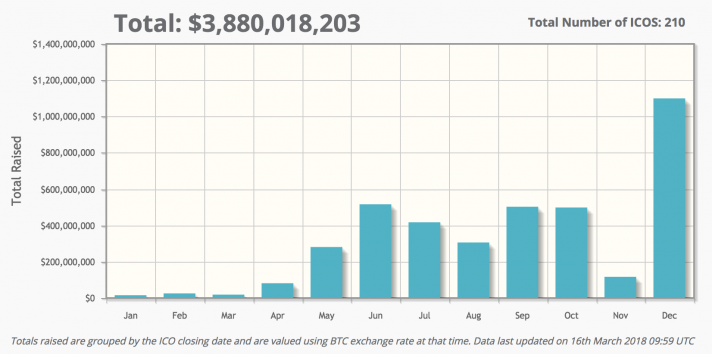

ICO Competition is heating up, with 210 ICOs funded last year vs 43 in 2016:

Source: https://www.coinschedule.com/stats.html?year=2017

Here’s What We’re Doing

We were brought in to address the above challenges.

Our philosophy is that to achieve successful funding, sound deployment of funds raised, gain widespread usage and increase in token value, we need to have publicity and scale.

To achieve these 2 things, we recommend that companies pursuing an ICO acquire related sites both before and after the ICO.

This will garner credibility for the startup and bring on customers. We’ll deep dive into these points below:

Pre-ICO

The Secret to Easy Publicity

To rise above the noise, people need to know about your existence i.e. you need visibility. The more the exposure, the more the number of people who know about the project.

This, in turn, increases the number of potential investors. There’re several ways you can get publicity—PR, SEO, social media, etc.

We have extensive experience in marketing and advertising to get buzz for ICOs.

In our experience, instead of spending on expensive PPC ads, it’s simply more efficient to go for vertical integration, acquiring sites up or downstream. We’re helping the company to acquire:

- a tech news site with 50m+ views/year and

- a network of finance sites that ranks for both the Spanish and Portuguese equivalents of “loans” and “personal loans” in Mexico, Brazil, Argentina, Colombia and Peru

Thanks to these acquisitions, we can put ads for and also link out to the company’s ICO. When you own the assets, you have total freedom as to how to market them.

Not only that, we get to inherit these sites’ existing user base and merchant relationships.

This is much cheaper than doing PPC to get eyeballs. Paying for traffic on competitive terms such as “loans” for 1 year is hella expensive. It would have cost the equivalent of a site (or more).

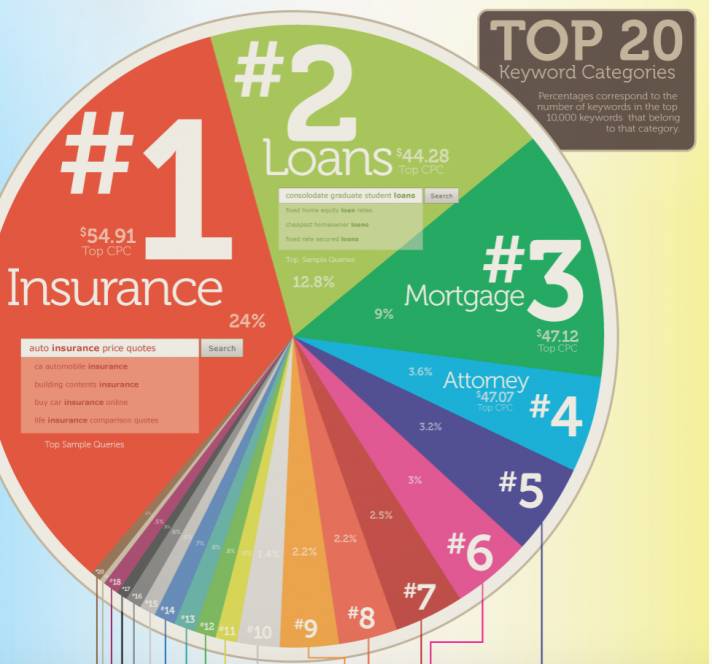

Loans are the #2 most expensive PPC keyword according to wordstream.com

Post-ICO

Earn Credibility via Scale

The chances of success post-IPO is much higher if the startup has scale. Why? Let’s illustrate with an exercise.

What comes to mind when we mention brands like Apple, Amazon and Netflix? They’re household names that everyone knows and trust. You trust that they’ll deliver the goods.

Very few people would hesitate to buy from a household name. But many would when presented with an unknown name. Найти эскорт в Казахстане – легко. Обаятельные проститутки в алматы ждут вашего звонка.

In the crypto world, it’s easier to gain trust and credibility if the startup is bigger and more well-established.

The more the number of people who know about you, the more people would trust you. By acquiring other high-traffic sites, we’re letting more people know about the company.

Gain Widespread Usage of Core Product & Increase in Token Value

For there to be value in holding the token long term, there must be sufficient demand for the core product and an ecosystem for the token.

When the startup acquires other related sites, the sites come with existing user bases and merchant relationships which it can leverage.

Thus, it’s easier to gain critical mass in terms of use cases. As the next step post-ICO, we plan to help the company acquire other smaller P2P lending companies as well as more publishers.

Sound Deployment of Funds Raised

The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” —Warren Buffett

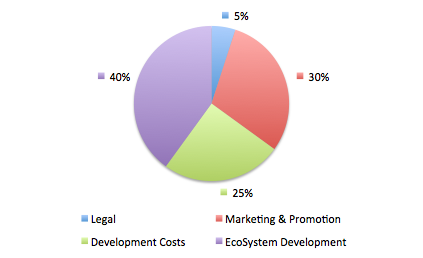

The funds raised from the ICO are not entirely spent on development. Below is how we might advise a startup to allocate their funds:

The core product needs time to be built and doesn’t make money straightaway.

An efficient way to deploy the funds left after subtracting the development costs is to acquire profitable sites in the same/related niches.

When doing acquisitions, we advise clients to pick sites with lower price-earning ratio and buy at a lower multiple.

By doing so, the startup benefits from the cash flows of the acquired sites and is operationally profitable from Day 1, even after all the development costs.

Other Examples

Besides the finance space, let’s try applying the same idea to ICOs in other industries.

Travel & Tourism

For a cryptocurrency used by travellers for payment in the travel and tourism industry, the type of sites the startup can purchase to complement its core product are:

- Regional flight and hotel/resort booking and deals sites

- Restaurant and tour booking and deals sites

- Airport pickup and car rental booking sites

- Travel blogs

Recruitment

For a cryptocurrency like Chronobank that is used by employers and employees to pay for services rendered, the type of sites the startup can purchase to complement its core product are:

- Regional job boards

- Freelancing blogs and sites

- Sites for hiring virtual assistants

- Invoicing/accounting apps

Key Takeaways

M&A helps cryptocurrencies:

- Generate easy publicity

- Gain credibility

- Scale adoption and token value

- Become operationally profitable

Are you a crypto enthusiast? Learn more about our apprenticeship program in Valle de Bravo. Can you apply this idea to an ICO in another industry? Drop us a comment below and share this post!

Author Bio

Karen Foo is a deal flow expert and digital marketer with experience in a wide range of industries from finance to education. She is a National University of Singapore Business School graduate and her corporate career spans Europe and Asia. You can tweet her here (https://twitter.com/tsueyer).