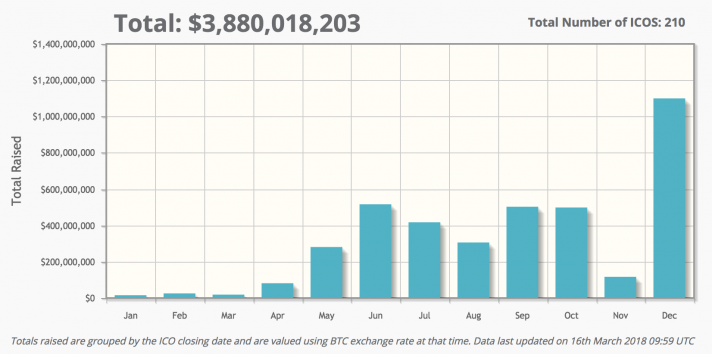

$96,389,917. That’s the total amount raised from 46 ICOs in 2016.

In 2017, the total amount raised from ICOs has skyrocketed to $3,880,018,203 with 210 ICOs taking place in 2017. It’s one reason why marketers are moving to crypto.

With the meteoric rise in the number of ICOs and the amounts they raise, there’re bound to be winners and losers. Here are 2 famous ICO examples:

Successful ICO: Ethereum in 2014

The team behind the Ethereum ICO raised $18m over the course of 42 days

when they launched.

Ever since then, Ethereum has quickly grown and successfully became the second-most valuable cryptocurrency ecosystem in the world today.

Failed ICO: The DAO in 2016

On paper, the DAO had a lot of promise, it gave investors voting rights on proposals, thus creating decentralized, autonomous organizations.

On paper, the DAO had a lot of promise, it gave investors voting rights on proposals, thus creating decentralized, autonomous organizations.

The team raised $152m in total during the ICO. But the platform’s code was buggy and it was attacked multiple times, resulting in the loss of several millions worth of funds.

In the end, the whole project was put on hold, and existing DAO tokens were converted back to Ethereum.

It’s a valuable lesson of how successful funding is only one aspect of running a business.

What’s the difference between these two examples? How do you turn your ICO into a success and avoid becoming a failed statistic?

What Is an ICO & How Does It Work?

Initial Coin Offers (ICOs) is like the love child of crowdfunding and IPOs. It allows startups to gain direct access to a pool of investors via cryptocurrencies.

Much like an IPO, startups raise funds through cryptocurrencies and investors in turn are given ownership to a pre-agreed amount of tokens or cryptocoins which functions like shares.

There’re usually 2 stages in an ICO:

- Pre-Sale: targets accredited investors

- Crowd Sale: open to all, ends based on amount raised/time period

Soon after an ICO is finished, the goal (and expectation) is generally to get the token listed on as many big cryptocurrency exchanges as possible.

Note: Getting listed on exchanges can happen even before the tokens become usable for their stated intent.

Being listed provides the secondary market where early contributors to the ICO can then sell, buy more or exchange their tokens.

If a token becomes more popular (more and more people want to buy it) in the time between the ICO and being listed on exchanges, its price rises.

The post-ICO phase is all about delivering value for customers and token holders via continued development of the product and following the product roadmap.

Compared to an IPO and its strict regulations, it’s much easier to raise money via an ICO, which is currently unregulated.

So you see many startups jumping on the ICO bandwagon in order to capitalize on the opportunity.

This is going to turn arrogant venture capitalists on their heads,” – Michael Jackson, a partner at Mangrove Capital Partners.

Here’s how a typical ICO timeline might look:

As you may or may not know from the new about page, we are running a little incubator for cryptocurrencies down here in Valle de Bravo. Here’s a look at some of the key activities our apprentices are working on:

- Manage fundraising with a minimum target of $10m (cap of $50m)

- Develop and optimize contributor funnel

- Engage with and close contributors

- Identify, engage and manage all third-party contractors

- Develop one-pager, presentation, and white paper

- Create copy for marketing videos and advise on website copy and design

- Manage approved ad spend to generate contributor demand

- Acquire and operate related sites that complement the core product

- Seeing who can do the longest headstand on a paddleboard

They will also assist the CEOs of businesses we invest in to:

- Update the website and copy

- Film a promo video on the product and project

- Sign off on the marketing and promotion plan

- Engage with the smart contract development firm to tokenize the service

- Manage the support team corresponding on product/token questions

- Conduct media appearances (tv, podcasts, blogs, etc) to promote the launch

- Appear on webinars to engage with contributors

- Travel as required to promote the launch

Successful apprentices have the opportunity to eventually become the CEO of a business as well.

If that sounds interesting to you, apply for the apprenticeship here.

Bottom Line

ICOs are a great way for startups to raise funds through tokens. Contributors gain access to a project by sending a startup money, and get the equivalent amount of tokens in return.

This provides funds for the startup to develop the promised technology. But because there’re so many startups jumping on the ICO bandwagon, it’s hard to stand out from the crowd.

Key Takeaways

The goals of a startup doing an ICO are to:

- Create tons of buzz and reach the funding target

- Attract more users and increase demand for and value of the token

- Deploy funds raised effectively

To achieve these goals, the startup needs publicity and scale. We recommend that startups acquire related sites that complement their core product because:

- Advertising through these sites is way cheaper than buying PPC ads to create buzz

- A more established brand lends credibility to the project

- The existing user bases of the sites can feed into demand for the core product and an ecosystem for the tokens

- This yields a high ROI from the funds raised, resulting in positive cashflow from Day 1

Don’t forget to share this post, and drop us a comment below with any questions about the ICO process.

Author Bio

Karen Foo is a deal flow expert and digital marketer with experience in a wide range of industries from finance to education. She is a National University of Singapore Business School graduate and her corporate career spans Europe and Asia. You can tweet her here (https://twitter.com/tsueyer).